Agency problems as a theoretical framework for option remuneration plans: main contributions

Keywords:

firm theory, information asymmetry, adverse selection, option plansAbstract

The aim of this essay is to present, very succinctly, the evolution of the theoretical framework of the firm in relation to agency theory and its tensions due to the separation of control by shareholders. In addition, there will be a tour of the main works that linked the problem of the principal-agent, to the existence of a paradigm to deal with the problem of managerial remuneration for option plans.Downloads

References

Adam, A. (2002). “Enron-Andersen Un caso para análisis y reflexión”. Contaduría y Administración, 207, 31-37.

Aghion, P. & Holden, R. (2011). “Incomplete Contracts and the Theory of the Firm: What Have We Learned over the Past 25 Years?”. Journal of Economic Perspectives, vol. 25, 2, 181-197.

Akerlof, G. (1970). “The market of Lemons: quality uncertainty and the market mechanism”. Quarterly Journal of Economics, 84, 488-500.

Allais, M. (1953). “Le Comportement de l'homme rationnel devant le risque: critique des postulats et axiomes de l’ecole americaine”. Econometrica, vol. 21, n° 4, 503-546.

Álzate Marín, J. J. (2016). “Los aspectos institucionales que influyen en un cambio en la Contabilidad de Gestión”. Revista Science of Human Action, vol.1, 1, 87-102.

Archibald, G. C. (1998). “Theory of the firm”. En Eatwell, J., Milgate, M. & Newman, P. (eds.). The New Palgrave – A Dictionary of Economics. London: Macmillan.

Arévalo, B. J. & Ojeda, J. J. (2004). “Riesgo moral y contratos: cierta evidencia experimental”. Revista de Economía Institucional, vol. 6, 10, 47-69.

Argandoña A. (2000). “La remuneración de directivos mediante opciones sobre acciones: aspectos económicos y éticos”. Documento de investigación N° 411, IESE, Barcelona.

Banerjee S., Gatchev, V. A. & Noe, T. H. (2008). “Doom or Gloom? CEO stock options after Enron”. EFA 2018 Athens Meetings paper.

Bizjak, M. J., Brickley, J. A. & Coles, J. (1993). “Stock-based incentive compensation and investment behavior”, Journal of Accounting and Economics, 16, 1-3, 349-372.

Barona-Zuluaga, B. & Gómez-Mejía, A. (2010). “Conceptual and empirical aspects of the financing of new companies in Colombia”. Cuadernos de Administración, vol. 26, 43, 81-98.

Berle, A. A. Jr & Means, G. C. (1932). The modern corporation and private property. New York: Macmillan.

Black, F. & Scholes, M. (1973). “The pricing of options and corporate liabilities”. Journal of Political Economy, 81, 3, 637-659.

Bomeli, E. (1972). “Stock Option Plans -- Full Disclosure”. The Accounting Review, vol. 37, 4, 741-745.

Call, C. A., Kedia, S. & Rajgopal, S. (2016) “Rank and file employees and the discovery of misreporting: The role of stock options”. Journal of Accounting and Economics, vol 62, 2-3, 277-300.

Chaigneau, P. (2018). "Managerial Compensation and Firm Value in the Presence of Socially Responsible Investors," Journal of Business Ethics, Springer, vol. 149, 3, 747-768.

Coase, R. H. (1937). “The nature of the firm”. Economica, vol 4, 16, 386-405.

Coase, R. H. (1960). “The problem of social cost”. Journal of Law and Economics, 3, 1-44.

Demsetz, H. & Lehn, K. (1985). “The structure of corporate ownership: causes and consequences”. Journal of Political Economy, 93, 1155-1177.

Dutto, G. M. & Beltrán, C. (2011). “La selección adversa y el riesgo moral en los contratos de construcción de obras”. Ciencias Económicas. Revista de la Facultad de Ciencias Económicas, vol. 2, 9-19.

El Alabi, E. & Milanesi, G. (2015). “Evolución de las funciones de utilidad para la toma de decisiones”. Escritos Contables y de Administración, vol. 6, 1, 15-4.

Ermel, M. D. A. & Medeiros, V. (2019). “Stock-based compensation plan: an analysis of the determinants of its use”. Revista Contabilidade & Finanças, vol. 31, n° 82, 84-98.

Favaro Villegas, D. (2013). “Enfoques de la teoría de la firma y su vinculación con el cambio tecnológico y la innovación”. Revista Cultura Económica, vol. 31, n° 85, 51-70.

Fisanotti, L. (2014). “Antecedentes históricos de los mercados de futuros y opciones: cobertura y especulación”. Invenio, vol. 17, 33, 9-19.

Foreman-Peck, J. & Hannah, L. (2012). "Some Consequences of the Early Twentieth Century Divorce of Ownership from Control," Working Papers 0023, European Historical Economics Society (EHES).

Friedman, M. & Savage, L. J. (1948). “The utility analisys of choices involving risk”. The Journal of Political Economy, vol. 56, n° 4, 279-304.

García Garnica, A. & Taboada Ibarra, E. L. (2012). “Teoría de la empresa: las propuestas de Coase, Alchian y Demsetz, Williamson, Penrose y Nooteboom”. Economía: Teoría y práctica, n.36, 9-42.

Grossman, S. J. & Hart, O. D. (1983). “An analysis of the principal-agent problem”. Econometrica, 51, 7-46.

Hall, B. J. & Murphy, K. J. (2003). “The Trouble with Stock Options”. Journal of Economic Perspectives, vol. 17, 3, 49–70.

Hallock, F. K. & Olson, C. A. (2010). “New Data for Answering Old Questions Regarding Employee Stock Options”. En Abraham, G. K., Spletzer, J. R. & Harper, M. (eds.). Labor in the New Economy. Chicago: University of Chicago Press.

Heath, C. & Huddart, S. (1999). “Psychological factors and stock option exercise”. Quarterly Journal of Economics, vol. 114, 2, 601–627.

Hull, J. C. (2012). Options, futures, and Other Derivatives. New York: Prentice Hall.

Jensen, M. C. & Meckling W. H. (1976). “Theory of the firm: managerial behavior, agency costs and ownership structure”. Journal of Financial Economics, vol. 3, 305-360.

Kartadjumena, E. & Rodgers, W. (2019). “Executive Compensation, Sustainability, Climate, Environmental Concerns, and Company Financial Performance: Evidence from Indonesian Commercial Banks”. Sustainability 2019, 11, 6, 1673.

Kelso, L.O. & Adler, M.F. (1958). Manifiesto Capitalista. Buenos Aires: Colección Cúpula, Guillermo Kraft LTDA.

Klein, B., Crawford, R. G. & Alchian, A. A. (1978). “Vertical integration, appropriable rents, and the competitive contracting process”. Journal of Law and Economics, 21, 297-236.

Krause, M. (2000). “La teoría de la agente y el principal en la estructura de la empresa”. Revista Libertas, 33, ESEADE, Buenos Aires.

Landro, A. H. & Gonzales, M. L. (2016). “Acerca del criterio de optimización basado en la maximización de la función de utilidad esperada”. Cuadernos del CIMBAGE, n° 18, 109-134.

López Rodríguez, J. D. (2015). “Enron el Hito Contable”. En: Memorias I Jornada Internacional de Estudios Disciplinares en Contabilidad y I Encuentro De Estudiantes De Contaduría Pública. Universidad Militar Nueva Granada.

López Zafra, J. M. (2006). “De la convexidad de la función de utilidad. Aportaciones de Von Neumann Morgenstern al concepto de utilidad en economía”. Universidad Pontificia Comillas, ICADE, Madrid.

Luce, D. & Raiffa, H. (1957). Games and decisions. Introduction and critical survey. New York; John Wiley and Sons.

Mahajan, S. (2002). “Role of out-of-money options in executive compensation”. The Leonard N. Stern School of Business, Glucksman Institute for Research in Securities Markets.

Mas Colell A., Whinston M.D. & Green J.R. (1995): “Microeconomic Theory”, Oxford University Press, Oxford.

Mehran, H. (1992). “Executive incentive, plans, corporate control and capital structure”. Journal of Financial and Quantitative Analysis, 27, 539-560.

Melle, M. (1999). “Stock options, incentivos a la dirección y gobierno de empresas.”. Cuadernos de Información Económica y Financiera, 152-153.

Meramveliotakis, G. (2018). “New Institutional Economics: A Critique of Fundamentals & Broad Strokes towards an alternative theoretical framework for the analysis of institutions”. Asian Journal of Social Science Studies, vol. 3, n° 2, 50-64.

Merton, R. C. (1973). “Theory of rational option pricing”. Bell Journal of Economics and Management Science, 4, 141-183.

Neal, J. (2016). “The role of stock exchanges in financial globalization: A historical perspective”. En Chambers, D. & Dimson, E. (eds.). Financial market history: reflections on the past for investors today. London: CFA Institute Research Foundation.

Ricart, J. E. (1986). “Talento directivo, decisiones de inversión e información asimétrica”. Documento de Investigación DI-106, IESE.

Rosenberg, M. (2004). “Essays on stock option compensation and the role of incentives and risk”. Swedish School of Economics and Administration, n° 126, Helsingfors.

Santos, J. G. C. dos, Calíope, T. S. & Coelho, A. C. (2015). “Teorias da firma como fundamento para formulação de teorias contábeis”. Revista de Educação e Pesquisa em Contabilidade (REPeC), vol. 9, 1.

Screpanti, E. & Zamagni, S. (1997). Panorama de historia del pensamiento económico. Barcelona: Ariel.

Shan, W. & An, R. (2018). “Motives of stock option incentive design, ownership, and inefficient investment”. Sustainability 2019, 10, 10, 3848.

Smith, C. W. & Watts, R. (1992). “The investment opportunity set and corporate financing, dividend, and compensation policies”. Journal of Financial Economics, 32, 263-292.

Stumpff, A. (2009). “Fifty Years of Utopia: A Half-Century After Louis Kelso's ‘The Capitalist Manifesto’, a Look Back at the Weird History of the ESOP”. The Tax Lawyer, 62, 2, 419-431.

Tigre, P. (2005). “Paradigmas tecnológicos e teorias econômicas da Firma”. Revista Brasileira de Inovação, vol. 4, 1, 187-223.

Tzioumis, K. (2008). “Why do firms adopt CEO stock options? Evidence from the United States”. Journal of Economic Behavior & Organization, 68, 100–111.

Von Neumann, J. & Morgenstern, O. (1944). Theory of games and economic behavior. Princeton: Princeton University Press.

Williamson, O. E. (1975). Markets and hierarchies, analysis and antitrust: A study in the economics of internal organization. New York: Free Press.

Williamson, O. E. (1985). The economic institutions of capitalism: Firms, markets and rational contracting. New York: Free Press.

Downloads

Published

How to Cite

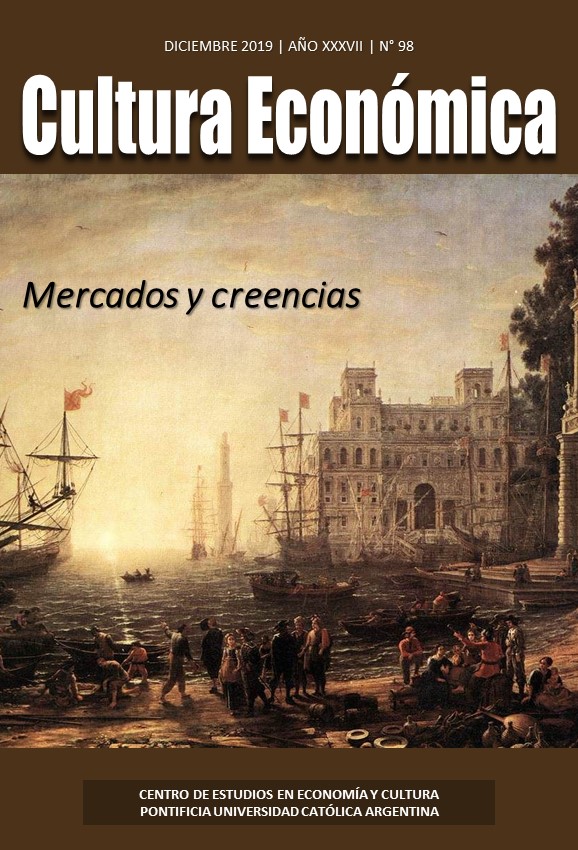

Issue

Section

License